How Seller Financing Can Put More Money in Your Pocket?

When it comes time to sell a business, most owners focus on one number — the sale price, but in reality, how you get paid can have an even greater impact on your total financial outcome, taxes, and peace of mind after the sale. One of the most powerful — and often overlooked — tools in small-business transitions is seller financing. Instead of receiving the full amount at closing, a portion of the price is paid over time, with interest, through a structured note between buyer and seller.

For many owners, this creates a win-win: it can expand the buyer pool, support a smoother transition, and often increase the total payout over the life of the note.

What Is Seller Financing?

Seller financing simply means you act as the lender for part or all of the sale. You receive monthly or quarterly payments with interest, secured by the business itself, rather than relying on a bank to fund 100% of the purchase.

This structure is especially common when:

- The business is stable and profitable, but might not qualify for full traditional financing.

- You want to help the next owner succeed — protecting your team, reputation, and legacy.

- You’d like to earn interest income over time, rather than taking all proceeds in one taxable lump sum.

Why Seller Financing Can Increase Total Payout

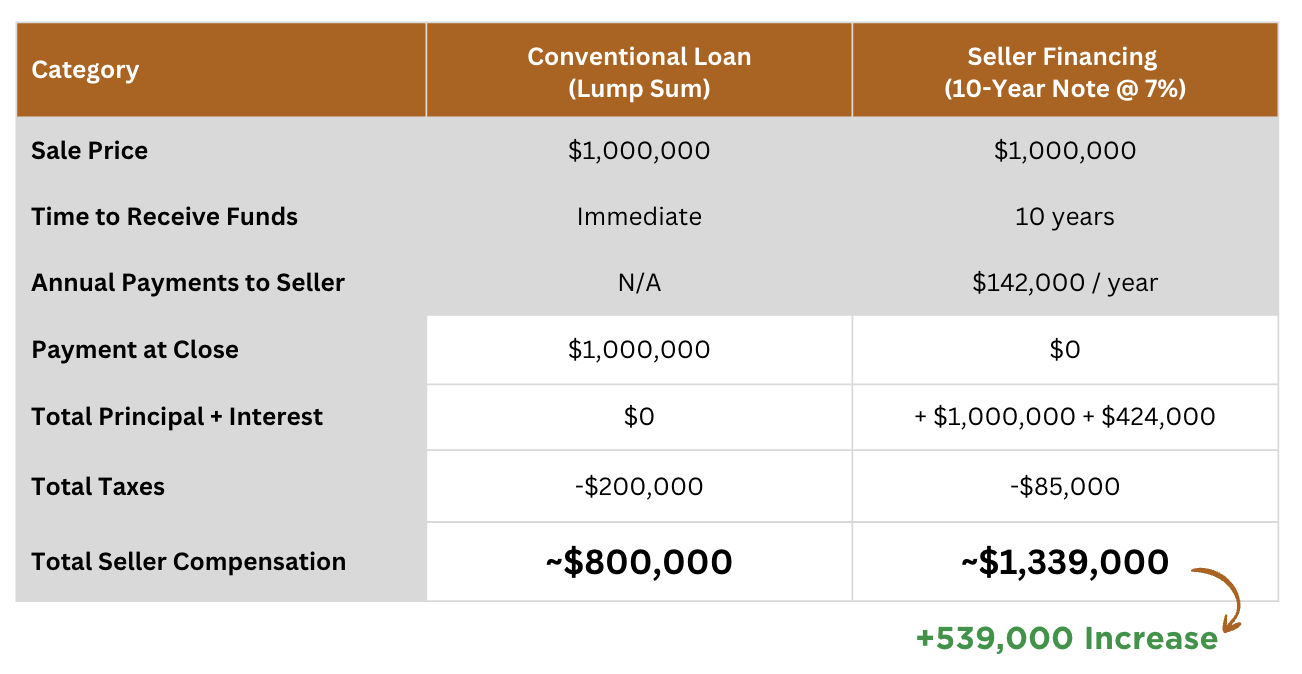

While every deal is different, the mechanics are simple: you earn interest on the unpaid balance, and when combined with potential tax deferrals from receiving income over multiple years, your total after-tax proceeds can exceed an all-cash sale. In this example, the business is selling for $1M under the seller-financed deal results in a 67% higher total payout, thanks to interest and reduced upfront taxation — without increasing the sale price.

Is Seller Financing Right for You?

Seller financing isn’t for everyone, but it can be a strategic fit if:

- You have a track record of stability in the business operations and revenue.

- You trust the buyer’s ability to operate and grow the business.

- You’re open to a structured payout that rewards you over time.

- You want to preserve your team and legacy during a thoughtful transition.

- You’re comfortable with risk associated with the buyer’s ability to meet repayment terms.

- You don’t have short-term liquidity needs and can afford to receive proceeds gradually rather than all at once.

If you’re considering this route, it’s best to work with your CPA to structure the note in a way that optimizes both taxes and security. Every deal is unique, and timelines can vary depending on financing layers, due diligence, and third-party approvals — especially if real estate or multiple lenders are involved.

The Bottom Line

Seller financing is about alignment. It gives qualified buyers the flexibility to move forward while giving you, the seller, an opportunity to earn more over time and see your business continue under the right hands.

Whether you’re planning to sell now or years from now, understanding how deal structure impacts what you take home can help you make confident, informed decisions when the timing feels right. If you have any questions specific to your business, I'm always happy to talk it through. Book your discovery call here.