How long does it really take to sell a business (by financing type)?

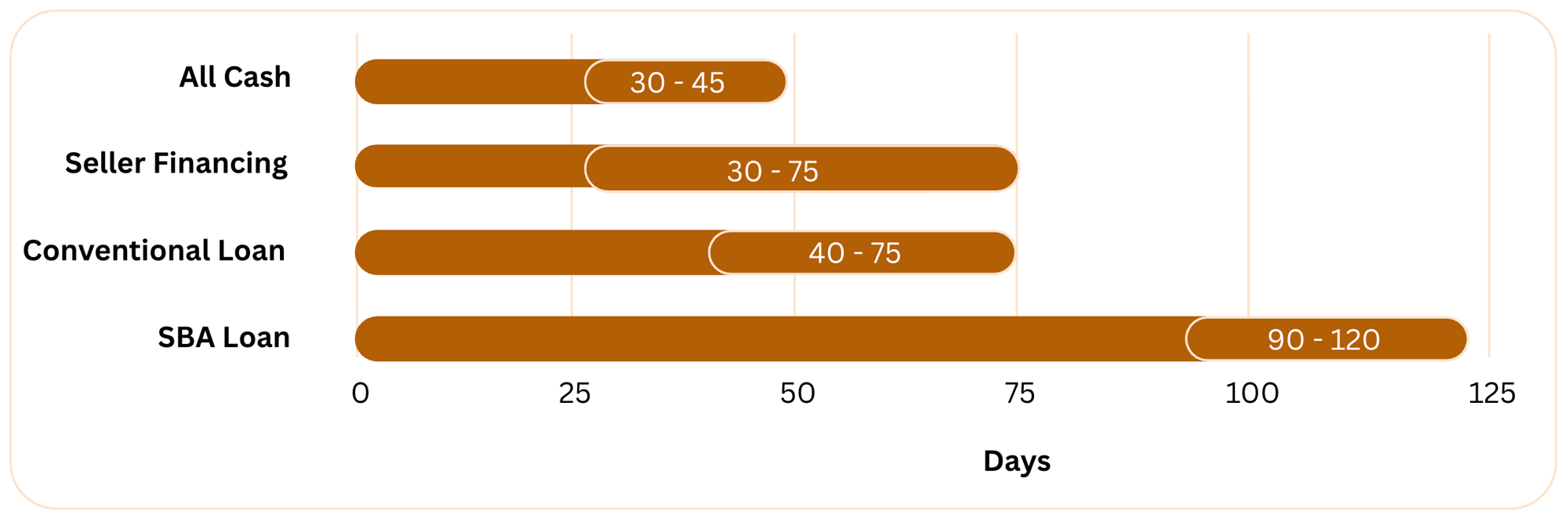

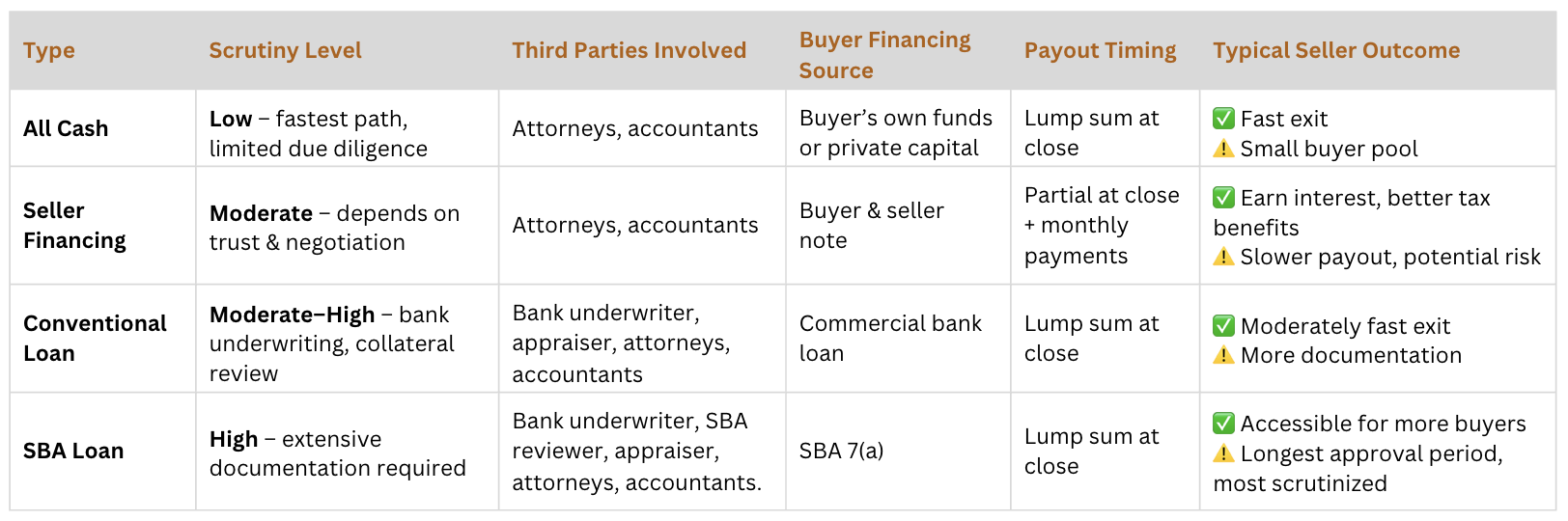

The time it takes to close a business sale can vary widely depending on how it’s financed. Each path comes with its own timeline, level of documentation, and number of third parties involved — but understanding the trade-offs early helps you plan ahead with confidence. All-cash sales close fastest but involve a smaller buyer pool. Seller-financed deals can take longer but may offer interest income and tax advantages. Bank-financed sales (conventional or SBA) reach the widest pool of buyers and provide a lump-sum payout at close.

Timelines can extend if real estate is included (often adding 30–45 days) or if lenders, attorneys, or appraisers delay documentation. Each deal is unique — these figures are general benchmarks, not guarantees. While no two transactions are the same, understanding the nuances of each financing path helps owners plan ahead and set realistic expectations. The more organized your financials and diligence materials are, the smoother and faster your closing will be.

Timelines by Financing Type

What are the steps in each financing type?

All-Cash Sale

An all-cash deal means the buyer pays the full purchase price upfront without involving any lender or financing source. These transactions move quickly and carry the least complexity but typically attract fewer qualified buyers. This financing type prioritizes speed and simplicity, but the buyer pool is much smaller.

Step 1: Agree on Price and Terms

Once buyer and seller align on valuation and structure, a short Letter of Intent (LOI) confirms the offer.

Step 2: Light Confirmatory Diligence

With no lender involved, diligence is more limited to reviewing financial statements, contracts, and liabilities to confirm accuracy.

Step 3: Legal Documents and Closing

Attorneys finalize the purchase agreement, funds are wired, and ownership transfers immediately.

Seller Financing

In seller financing, the seller acts as the lender for part (or all) of the purchase price, receiving regular payments over time with interest. This can allow allows sellers to earn income post-sale and gain tax advantages. This financing type appeals to sellers seeking steady income and potential tax benefits.

Step 1: Negotiate Financing Terms

Buyer and seller agree on down payment, interest rate, and repayment schedule. These arrangements rely on mutual trust and flexibility.

Step 2: Confirmatory Diligence

The buyer reviews the company closely, as repayment depends on future performance.

Step 3: Draft Promissory Note and Security Terms

Attorneys document the repayment structure and collateral terms.

Step 4: Close and Begin Installments

Seller receives the initial payment and collects monthly installments over time.

Conventional Loan

A conventional loan is provided by a commercial bank without an SBA guarantee. It’s typically used for larger, well-documented businesses with stable cash flow. These deals close faster than SBA loans, but require strong buyer financials. This financing type provides a full payout with moderate speed and more structured oversight.

Step 1: Loan Application and Bank Review

Buyer applies for a commercial loan. The bank reviews business financials, tax returns, and buyer creditworthiness.

Step 2: Underwriting and Appraisal

The bank underwrites the deal and may require an appraisal or collateral analysis. This stage typically takes the longest.

Step 3: Legal Preparation and Closing

Once approved, attorneys finalize loan and purchase documents. Buyer wires the down payment and the bank funds the rest.

SBA Loan

An SBA 7(a) loan is partially guaranteed by the U.S. Small Business Administration, allowing banks to lend to qualified buyers with smaller down payments. This makes it one of the most common financing paths for main-street business transactions. The trade-off is additional paperwork and more stringent approval steps. This financing type generally has the broadest buyer access, but the slowest and most paperwork-heavy process.

Step 1: Prequalification with SBA Lender

The buyer is prequalified through an SBA-approved bank (the SBA guarantees part of the loan but does not lend directly).

Step 2: Sign Letter of Intent

Buyer and seller agree on price and structure before formal review begins.

Step 3: SBA Underwriting and Documentation

Extensive documentation is required from both buyer and seller, including tax returns, debt schedules, and financial statements.

Step 4: Appraisals and Government Review

If real estate or equipment is included, appraisals and environmental reports are required before final approval.

Step 5: Legal Documentation, Funding, and Closing

Once approved, attorneys finalize agreements, the SBA issues its guarantee, and funds are disbursed.

If you're interested in learning about how financing could affect a sale for your business — I'm always happy to talk it through. Book your discovery call here.

Note: These sequences reflect typical deal flows from the signing of a Letter of Intent to closing. Actual timelines depend on deal size, responsiveness, third-party turnaround times, and whether real estate is included.

Sources: BizBuySell Insight Report; Pepperdine Private Capital Markets Report; SBA Loan Data, U.S. Small Business Administration.